Small Bank on the Prairie - Why Jacksonville Bancorp is Undervalued

Author's Note: The following article refers to Jacksonville Bancorp Inc (JXSB) based in Jacksonville, IL that trades around $17 per share (as opposed to the Jacksonville, FL-based bank of the similar name that trades under JAXB). In July 2010, the firm converted from a mutual-holding company to a stock-holding company that is fully-owned by the public.

Investment Thesis

- Jacksonville Bancorp has good management, has fared well during the financial crisis (primarily because it engages in low-risk activities), and has efficient operations.

- The bank has good asset quality, few problem loans, and is well reserved to cover future losses (especially when compared with its peers).

- The company trades at a low P/E, at less than tangible book value despite the quality of the balance sheet, and has room to increase the dividend.

Bank Operations

Overview of the Bank

Founded in 1917, Jacksonville Bancorp is a community-oriented savings bank headquartered in Jacksonville, Illinois. The bank's main business is the "spread business" - attracting funds primarily from deposits to originate loans at higher rates. On the balance sheet, the bank has about $316M in assets. These assets are comprised of $171.7 in net loans receivable, $48.1M in mortgage-backed securities, and $61.3M in investment securities (primarily A rated or higher municipal bonds). The bank's liabilities total $271.0M of which the vast majorities - $258.5M - are deposits. The bank's loans receivables and its lending policies are summarized below:

Loan Portfolio Composition

|

% of Gross Loans

|

Lending Practices

|

One to Four Family (Real Estate)

|

24.2%

|

- Offers both fixed-rate and adjustable-rate mortgages (ARMs) up to 30 years - ARMs have interest rate caps of 200 bps per year and 600 bps per the life of the loan.

- Mortgage payment generally limited to 28% of monthly income; When LTV is greater than 80%, private mortgage insurance is required.

- Does not offer subprime, Alt-A, interest only, or negative amortization loans

|

Commercial (Real Estate)

|

19.9%

|

- Offers adjustable-rate loans with terms of up to 5 years

- Generally, LTV cannot exceed 80% and projected net cash flow to loan's debt service requirement should be greater than 120%

|

Agricultural (Real Estate)

|

19.8%

|

- Offers adjustable-rate loans with terms of up to 5 years

- Generally, LTV cannot exceed 80% and projected net cash flow to loan's debt service requirement should be greater than 120%

|

Home Equity (Real Estate)

|

7.6%

|

- Offers both fixed rate and adjustable rate. Maximum term is generally 10 years

- Maximum Line of Credit is generally 95% of appraised equity value

|

Commercial (Non-Real Estate)

|

15.1%

|

-Offers secured and unsecured loan

-Generally adjustable rate with terms from 3-5 years

|

Agricultural (Non-Real Estate)

|

5.0%

|

-Generally offers fixed rate loans with terms of up to 5 years

|

Consumer (Non-Real Estate)

|

8.3%

|

-Generally offers fixed rate loans

-Originates auto-loans usually with less than 80% LTV or 100% NADA loan value

|

Total

|

100.0%

|

Total Gross Loans = $174.9M, Net Loans = $171.7M

|

Source: 10-Qat 9/30/2012

|

By not offering or investing in subprime or Alt-A loans, the bank was able to survive the financial crisis. The bank continued to pay its regular dividend to common shareholders throughout the financial crisis and did not participate in TARP's Capital Purchase Program.

Management and Operating Efficiency

The bank's management has remained stable. Richard Foss has served as CEO since 2001 and has been with the company since 1986. Andrew Applebee has served as the Chairman of the Board since 1994 and has been with the company since 1976. Other executive offices also have long tenures with the company.

Operationally, the bank remains reasonably lean. The efficiency ratio consists of non-interest expense (less amortization of intangibles) divided by the sum of non-interest income and net-interest income and can be thought of how much it costs the bank to raise $1 in revenue. A lower number indicates greater efficiency. Compared to other savings institutions of comparable size (larger banks typically have efficiency ratios around 55%), the bank's efficiency ratio has improved relative to its peers.

Source: FDIC, all years from Jan. 1 - Dec. 31 except 2012 is from Jan. 1 - Sept. 30. Peer Group consists of saving institutions with assets $300M-$500M.

Bank is Well Capitalized based on Capital Adequacy Ratios

By traditional capital adequacy ratios, the bank remains well capitalized and exceed minimum requires by a comfortable margin (see chart below). Under Basel II, the Allowance for Loan Losses (ALL) is limited to 1.25% of a bank's risk-weighted assets (RWA) for calculation in total risked-based capital; the bank has ALL in excess of 1.25% to RWA to further absorb any losses.

Regulatory Capital Ratios

|

Minimum Required

|

12/31/2011

|

9/30/2012

|

Tier 1 Capital (to total assets)

|

4.00%

|

10.35%

|

10.70%

|

Tier 1 Capital (to RWA)

|

4.00%

|

15.42%

|

16.08%

|

Total Capital (to RWA)

|

8.00%

|

16.67%

|

17.33%

|

Source: 10-Q at 9/30/2012

Asset Quality and Loan Loss Reserves

A Look at Nonperforming Loans and Assets

Source: FDIC, 2007-2011 at year-end, 2012 at 9/30; Peer Group consists of saving institutions with assets $300M-$500M.

The bank's asset quality remains strong. As we can see, Jacksonville Bancorp consistently has had lower rate of non-performing assets and loans than its peers. Non-performing Loans consist of loans that are either not accruing or are 90 days past due. Non-performing Assets include non-performing loans and foreclosed real-estate. As of Sept. 30, 2012, $1.825M in loans are non-performing of which $806K are 90 days past due. Finally, the company's real estate that it has foreclosed on (known as OREO - Other Real Estate Owned) is minimal. As of September 30, 2012, the bank held $167K in real estate from foreclosures.

Jacksonville's non-performing loans are primarily secured real estate:

2007

|

2008

|

2009

|

2010

|

2011

|

2012*

| |

Non-Performing Loans (NPL)

|

1,091

|

1,191

|

1,954

|

3,134

|

2,400

|

1,825

|

NPL Secured by Real Estate

|

978

|

1,112

|

1,474

|

2,944

|

2,082

|

1,659

|

Percent Secured

|

90%

|

93%

|

75%

|

94%

|

87%

|

91%

|

Source: FDIC, 12/31 for 2007-2011, 9/30 for 2012

| ||||||

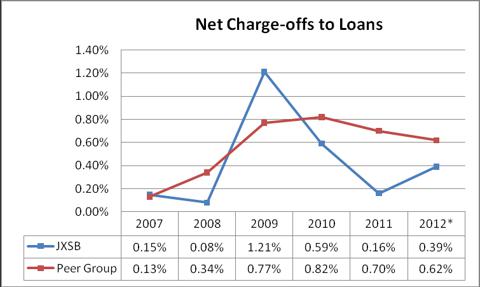

Finally, Jacksonville's net loan charge-offs rate - a measure of a bank's loans that are highly unlikely to be uncollected less recoveries - has been lower than its peers in every year except 2009. The net loan-charge off rate can be volatile for heterogeneous loans and the increase in charge-off rate in 2009 is due to deterioration in two commercial loans.

Source: FDIC, 2007-2011 at year-end, 2012 at 9/30; Peer Group consists of saving institutions with assets $300M-$500M.

Bank has Adequate Reserves to Cover Losses

The allowance for loan losses is reserve account that represents management's best estimate of future credit losses on its loans. The ALL is relatively discretionary as it is subject to bank management and is accounted for before the losses actually occur or are probable. In contrast, non-performing loans are relatively non-discretionary and are more accurate of the current loan quality.

Source: FDIC, 2007-2011 at year-end, 2012 at 9/30; Peer Group consists of saving institutions with assets $300M-$500M.

A ratio of 173% indicates that even if Jacksonville Bancorp lost everything on its non-performing loans (of which 91% are secured by at least some real estate), it would still hold reserves to cover an additional $0.73 of losses in performing loans per dollar of non-performing loans. While such a high ratio may be warranted in credit-risky lending as the ALL has to cover losses for both performing and non-performing loans, the high ratio relative to its peers and its conservative lending indicate safety conscious management that has adequately (or more than adequately) reserved for future losses.

Valuation

Trades at low P/E and Less than Book Value

P/E Ratios

|

Earnings (M)

|

Market Cap

|

P/E

|

TTM Earnings (10/1/11-9/30/12)

|

$3.57

|

$33.2

|

9.3

|

FY 2011 Earnings (1/1/11-12/31/12)

|

$3.29

|

$33.2

|

10.1

|

P/B Ratios

|

Book Value

|

Market Cap

|

P/B

|

Stockholder's Equity

|

$44.58

|

$33.2

|

0.74

|

Stockholder's Equity less Goodwill

|

$41.85

|

$33.2

|

0.79

|

Stockholder's Equity less Goodwill and AOCI (unrealized gains)

|

$38.22

|

$33.2

|

0.87

|

The bank trades at 9.3 times trailing earnings. While I would caution against using sector averages because of the presence of unprofitable banks and differences in operating activities among the banks, healthy financials often trade at 10-15 times earnings. (Thrift and Mortgage Finance Sub-Industry ttm P/E 13.42 source: Charles Schwab).

When it comes to book value, the bank trades below the book value of equity even if we account unrealized gains and goodwill (see chart above). Given the recent financial crisis, it is not unusual for banks to trade below book value as investors may not trust the value of assets reported on the balance sheet (For instance, Bank of America, with its known problems, trades well below book value at 0.56 while Wells Fargo, "Warren Buffett's bank," trades at a premium to book value at 1.25, source: Yahoo Finance). In the case of Jacksonville Bancorp, the majority of its assets are loans, mortgage-backed securities, and investment securities (mainly investment grade municipal bonds). Loans are valued based on the receivables less the allowance for loan losses. As established earlier, the ALL is adequate based on the bank's nonperforming loans; the bank is not overstating its loans by under-reserving for losses. Since the bank's mortgage-backed securities and investment securities are listed as available for sale (as opposed to held-to-maturity), the fair value of these securities is recorded on the balance sheet. Thus, the numbers on the bank's balance sheet are an accurate representation of the bank's assets.

Because of the small market cap (and the lack of analyst coverage), as well as the performance of other financial institutions during the subprime crisis, the bank is trading at a discount to book value that is not merited. Given the bank's strong asset quality and capital adequacy, the low P/B suggests undervaluation. A price to tangible book value (shareholder's equity less goodwill) of 1, which I believe is fairly conservative given the bank's performance, would result in a 26% increase in the share price.

Catalysts

Bank has room to increase dividend

As of December 31, 2011, the company can pay dividends of $5.8 million without regulatory approval. In 2012, the company will have paid regular dividend of $0.30 per share (0.075 per quarter) and a special before year-end dividend of $0.10 (ex-dividend date Dec. 19, 2012). With about 1.9 million shares outstanding, only $760K in dividends would be paid for all four quarters in 2012. Already, the company has reported $2.8 million in net income for the first three quarters of 2012. If the bank were to have zero net income in the fourth quarter, the payout ratio with the special dividend would only be 28%. In fiscal year 2011, the dividend payout ratio was 17%. Hence, even with the recent $0.10 special dividend, the company still has room to increase dividends based on the low payout ratio.

Next Earnings Release

Beyond an increase in the regular dividend, the bank's earnings release could be a catalyst going forward. The bank is expected to release fourth quarter results in mid-January 2013. The bank's fiscal year 2011 net income was $3.3M, up from fiscal year 2010's net income of $2.1M. The bank has already reported net income of $2.8M for the first three quarters of 2012. Even if the earnings growth trend slows, fiscal year 2012 net income will likely be greater than the prior year. Considering the low P/E, increases in year-over-year earnings could drive the share price higher.

Investment Risks

Interest Rate Risk

While this article has largely focused on credit risk, the bank still faces interest rate risk. Management states that its policy of reducing interest rate risk involves better asset-liability management, originating and retaining adjustable rate loans and loans with shorter durations, and increasing fee-based services. Of the bank's total loans due after Dec. 31, 2012, $73.6M were fixed rate while $67.3M were adjustable rate, so there is a mix of fixed rate and rate-sensitive loans. According to the bank's Asset-Liability Committee (ALCO), a rate shock of an increase of 300 basis points to a decrease of 100 basis points will not change Net Interest Income by more than 3%. Of course, these estimates are subject to certain assumptions and changes in the shape of the yield curve could have adverse effects on the bank.

It's a Small Bank in Rural Illinois

Finally, the bank is a small bank that is dependent on the economy of rural Illinois. Recent drought conditions in the Midwest have reduced crop yields and while management expects minimal impact on agricultural borrowers, future natural disasters in the region could have negative impacts. Because the bank is small, a few large borrowers defaulting can increase charge-offs.